Press Releases

Rumoured tax cuts would benefit men over women, finds WBG

Date Posted: Monday 4th March 2024

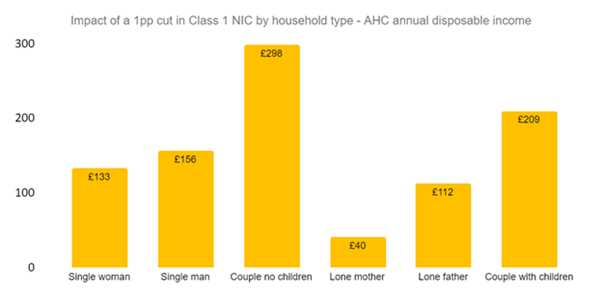

- Men would benefit more than women from the Chancellor’s rumoured plans to cut National Insurance Contributions (NICs) by 1 percentage-point, at a cost of about £4.5 billion a year,[1] with lone mothers gaining the least of working age groups at £40 per year compared to £112 for lone fathers and £298 for a couple with no children, distributional analysis from the Women’s Budget Group finds.

- Overall, on average men would stand to gain 9.4% more per year from the cut than women.

- Potential cuts to unprotected departments to fund tax cuts would come on top of the £19.1 billion real term loss in departmental spending by 2027/28 as a result of inflation and decisions made in the Autumn Statement 2023, as forecast by the OBR.[2]

- WBG, the UK’s leading feminist economics think tank, calls on the Government to invest in the public sector instead of implementing tax cuts – which will benefit the country as a whole and also provide better support to the most vulnerable households such as lone-mothers and others on low incomes.

Ignacia Pinto, Senior Research and Policy Officer at the Women’s Budget Group said,

“Cutting taxes and public spending under the banner of economic growth does not make sense. Even organisations like the IMF are warning against this.[3] If you dismantle the very foundations holding our economy together and undermine people’s ability to look after themselves and others, you will inevitably further weaken the economy and erode living standards. At the end of the day it is people who make up the economy. This is not a solution to the cost of living crisis; it’s a surefire way to prolong it.”

“These cuts would come on top of the NICs cuts announced back in the Autumn which we’ve seen have benefitted lone-mothers the least. [4] We know that these cuts aren’t what the public prioritise[5]. People in the UK recognise that taxes are the vital contribution they make to fund our social infrastructure, and they want to be able to get a nursery place for their child, see a doctor when they’re ill, and get support when they need it .”

Dr Mary-Ann Stephenson, Director of the Women’s Budget Group added,

“Rather than tax cuts, funded by another round of austerity, we need to invest in our public services that have already been cut to the bone. Birmingham City Council offers a glimpse into what many other local authorities will be facing soon: streets lights dimmed, uncollected rubbish piling up, libraries closing, and crucial services like youth groups, adult social care, and life-saving services for victim-survivors of domestic and sexual abuse slashed.

“We know from over a decade of austerity that when essential services contract or disappear, it is women who lose out the most: they rely more on public services, they make up the majority of its workforce, and they tend to fill in the cracks left behind by spending cuts through their own unpaid work.[6] This is a recipe for disaster for women.”

“The cost of living crisis is far from over, and as we have seen, it is women who remain the shock absorbers of poverty. Despite claims from the Chancellor that we’ve turned a corner, millions of women and low-income households across the UK continue to struggle. A jaw-dropping 15% of UK households experienced food insecurity last month,[7] at the same time that cost of living payments are ending. It’s unconscionable that the Government persists in prioritising tax cuts over public investment.”

Figure 1

ENDS

WBG Spokespeople available for comment, contact press@wbg.org.uk / 07799116631

[1]Jeremy Hunt plans national insurance cut and vape tax for budget

[2] Economic and fiscal outlook – November 2023 – Office for Budget Responsibility

[3] IMF warns UK government against further tax cuts – BBC News

[4] WBG full response to Autumn Statement 2023 – Womens Budget Group

[5] Minority Sport Fairness Foundation

[6] Triple Whammy: the impact of local government cuts on women (WBG)

[7] Food Insecurity Tracking | Food Foundation

Notes to Editors

- Figure 1: AHC equivalised disposable annual income for 2024. Comparison of the current scenario and a hypothetical scenario with a 1 percentage point cut in Class 1 Employee NIC (9% instead of 10%). WBG calculations using UKMOD B.109 with 2019 FRS data. UKMOD is maintained, developed and managed by the Centre for Microsimulation and Policy Analysis at the Institute for Social and Economic Research (ISER), University of Essex. The results and their interpretation are WBG’s sole responsibility.

- Today, the Women’s Budget Group has published a pre-budget briefing on Taxation and Gender: https://wbg.org.uk/analysis/spring-budget-2024-taxation-and-gender/

About the Women’s Budget Group

The UK Women’s Budget Group (WBG) is the UK’s leading feminist economics think tank, providing evidence and analysis on women’s economic position and proposing policy alternatives for a gender-equal economy. We act as a link between academia, the women’s voluntary sector and progressive economic think tanks.