Press Releases

Tax giveaways to better off men will cost worse off women, says WBG

Date Posted: Wednesday 6th March 2024

Tax giveaways to better off men will cost worse off women, says Women’s Budget Group

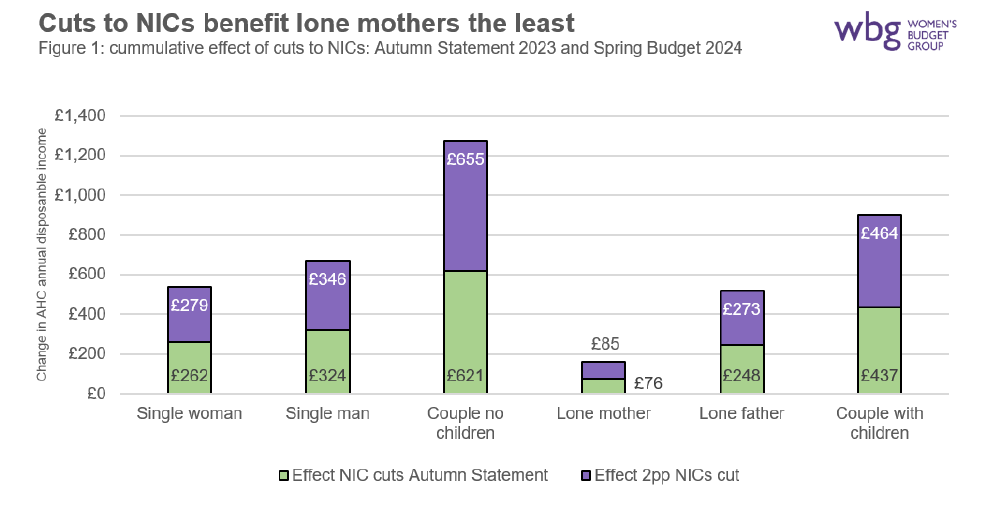

- Single men will gain on average close to £500 more a year than lone mothers from the combined cuts to National Insurance Contributions (NICs) in the Autumn Statement and Spring Budget, analysis by the Women’s Budget Group (WBG) finds, and couples without children will on average gain over £1,200 more a year.

- The cost of the latest cuts to NICs is £10.5bn per year. IPPR estimates that half will go to the wealthiest households and only 3% to the poorest, increasing relative poverty.[1]

- High inflation has eroded the budget for public services, meaning that unprotected services will see a 2.3 percent a year real terms cut in day-to-day spending from 2025/26, according to the OBR[2], which includes local government. These cuts will impact women more than men because they are more likely to use local services, more likely to work in them and more likely to have to take on additional unpaid work when services are cut.

Dr Mary-Ann Stephenson, Director of the Women’s Budget Group said,

“Yet again the Chancellor has announced tax give-aways that benefit men over women and benefit the better off rather than those most in need.

“At the same time as making tax cuts, the Chancellor has built in real terms spending cuts to unprotected departments equivalent to 2.3% a year. At a time when our public services are in crisis, and over 60 local authorities are warning they may face bankruptcy in the next year it beggars belief that a government thinks that tax cuts are a priority. They aren’t even popular with voters -only 16% of whom want to see tax cuts if it means cutting public services.[3

“Stepping back from the details of tax rates and fiscal rules, what was entirely lacking from the Chancellor’s budget was any long term vision for the country and the economy. Neither was there an acknowledgement of the environmental and ecological challenges we are facing and the decisive moment we are in.

“The supply side shocks to the economy that have driven much of the cost of living crisis will only continue as we experience ongoing impacts of the climate crisis globally and in the UK.”

“And as we have seen, it is women and other marginalised groups who bear the brunt of higher energy costs, greater food insecurity and extreme weather events. We desperately need political leadership at this moment, not political point scoring.”

Victoria Benson, Chief Executive of Gingerbread, said

“It’s a fact that single parent families are twice as likely to be living in poverty than couple parent families and the cost of living crisis has hit them hard. In addition, 90% of single parents are women – this means that all too often they face a double disadvantage when it comes to the Chancellor’s announcements on Budget Day.

“Today was an opportunity for the Chancellor to help lift children out of poverty but the announcements fell short of what is needed – we urgently need to see an uplift to Universal Credit to protect those on low incomes who have been struggling for too long. While we welcome the rise in the High Income Child Benefit Charge threshold and the commitment to change to a system based on household income, cuts to NICs benefit single parents least and single mums are helped even less than single dads.

“Increased investment in childcare is a step in the right direction, but more action is needed to ensure that single parents on the lowest incomes can benefit from high quality childcare which supports both their children’s development and enables them to find and stay in work. Those who are struggling most will find temporary relief in the six-month extension of the Household Support Fund but, in reality, it is little more than a sticking plaster. This much-needed support will end in September, before winter kicks in and people need to spend more on fuel.”

WBG comment on other areas of the budget – Dr Mary-Ann Stephenson, Director:

Child Benefit

“The changed threshold is a welcome first step. The change will be a relief to many parents, especially lone mothers, who are currently losing out on what should be a universal benefit for children. In high-cost areas like London, an income of £50,000 after tax is lower than median costs of rent, childcare and energy for a two-child household.

“However, we are very concerned about the move to a household means test for child benefit. Independent taxation and benefits are a key principle of women’s economic independence.”

On local government

“Local government is one of the areas most exposed to funding cuts. This has huge importance for women’s lives, as we have witnessed in recent months from the choices faced by councils up and down the country.

“Birmingham City Council has stripped back social care as well as non statutory services and is directly cutting up to 600 jobs[4]; Coventry is among several councils reducing or cutting life-saving services for survivors of domestic and sexual abuse and their children[5]; and Nottingham City Council has cut social and youth services[6].

“Further cuts come on top of an estimated 27% decrease in spending power for local services since 2010. We know that women are most affected because they work in these services, they and the people they care for rely on these services, and it is women’s shoulders the burden falls on when local services are stripped back.

“As we have seen in Birmingham, which is increasing council tax by 21% by April next year,[7] many areas will have no choice but to hike up council tax. This is a regressive tax because it takes up a higher proportion of income for low income households, council tax bands are out of date with the real value of people’s homes, and councils in poorer areas raise less from council tax (and business rates) but have greater need for their services.”

On services for survivors of violence against women and girls

“There was no new money for domestic and sexual violence services announced by the Chancellor despite the cliff edge faced by crucial services in 2025. With the spending constraints on local government we know that these vital life saving services have already been cut or are at risk of being cut locally.

“Already, Women’s Aid reports that 60% of referrals to refuges are turned away and 14,000 survivors of sexual violence are on the Rape Crisis waiting list. Services led ‘by and for’ Black and minoritised women are six times less likely to receive funding compared to other domestic abuse services. Without urgent investment these cuts will have devastating consequences.”

On fuel duty freeze

“The continued freezing of fuel duty is farcical, and makes no sense when we need to drastically reduce car use to stay within planetary boundaries. Furthermore, more men than women will benefit from the fuel duty freeze: 81% of men have a driving licence, compared to 71% of women[8], and 66% of men are the main drivers in their households compared to 54% of women[9].

“We also know that men tend to take longer car journeys than women, who are more likely to use public transport.”

On early education and childcare

“In less than a month the Government’s expansion of state-funded early education and childcare is due to begin roll out. We welcome the commitment to index payments for funded hours for the next two years. This is something that the Early Education and Childcare Coalition has been calling for.We wait for more detail about how this will be calculated.

“However, the gap between what the Government funds settings and what it costs to provide each place currently adds up to around £2bn a year for 3- and 4-olds and up to £5bn in total when the planned expansion is due to be fully rolled out in September 2025. Even with today’s announcement there is not enough to make up the shortfall.”

On Household Support Fund

“Extending the Household Support Fund will provide some a relief for both councils & those struggling to afford essentials. But these short-term initiatives are not a substitute for long-term funding for councils and a decent benefits system.”

On Non-Dom abolition

“We welcome the abolition of non-dom status, which is estimated to cost £3.6bn[10] a year in lost income tax and capital gains and disincentives investment in the UK.[11] This is also a change in support of gender equality because two thirds of non-doms are men.”

On Windfall Tax on Oil and Gas

“The extension of the windfall tax is good news, but we would like to see excess profits taxed at 100% rather than 35% because these are unexpected profits resulting from energy scarcity rather than any kind of productive activity. British Gas for example saw its profits increase ten fold last year, much of which is going to shareholders rather than supporting the households most affected by high energy prices.”

Notes to editors

- Analysis of NICs cuts: AHC equivalised disposable annual income for 2024. “Effect of 2pp NICs cut” is a comparison of the current scenario and a scenario with a 2 percentage point cut in Class 1 Employee NIC (8% instead of 10%) and a 2 percentage point cut in Class 4 NIC (from 8% to 6%). WBG calculations using UKMOD B.109 with 2019 FRS data. UKMOD is maintained, developed and managed by the Centre for Microsimulation and Policy Analysis at the Institute for Social and Economic Research (ISER), University of Essex. The results and their interpretation are WBG’s sole responsibility.

- Spending in real terms is protected for the NHS, defence, international development, schools and funding rates for childcare.

[1] Tax cuts will plunge thousands into poverty, thinktanks warn ahead of Jeremy Hunt’s spring Budget | The Independent

[2] https://obr.uk/efo/economic-and-fiscal-outlook-march-2024/#box-4.2

[3] https://fairnessfoundation.com/minority-sport?mc_cid=4353ebc46e&mc_eid=1300d57d26

[4] Birmingham City Council to vote on cuts after effective bankruptcy – BBC News

[5] UK charities warn of ‘devastating’ council cuts to women’s services | Violence against women and girls | The Guardian

[6] https://www.bbc.co.uk/news/uk-68476173

[7] https://www.bbc.co.uk/news/uk-england-birmingham-68483264

[8] Department for Transport, Full car driving licence holders by age and sex, aged 17 and over: Englanf, 1975 onwards: NTS0201

[9] Department for Transport, Full car driving licence holders by age and sex, aged 17 and over: Englanf, 1975 onwards: NTS0206

[10] https://arunadvani.com/papers/AdvaniBurgherrSummers_NondomBasics.pdf

[11] https://blogs.lse.ac.uk/businessreview/2023/01/20/non-doms-are-not-fleeing-tax-hikes/