Press Releases

Using today’s inflation rate for benefit rise would cost single mothers £218 a year says Women’s Budget Group

Date Posted: Wednesday 15th November 2023

The Women’s Budget Group urges the Chancellor to increase benefits in line with September CPI inflation as previously planned in his Autumn Statement next week. The changes come into force from April 2024.

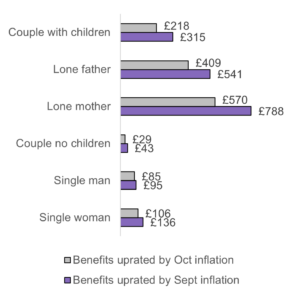

Increasing only in line with October’s inflation figures (published today) compared to September would mean a loss of £218 a year for single mothers.

Women’s Budget Group Analysis of the distributional impact of the changes to benefit amounts the Chancellor is rumoured to be considering found that:

- Any freeze in benefits or an increase below September CPI inflation would mean a cut in real terms, particularly affecting women, single mothers, disabled people, large families, and households on low incomes.

- If benefits are increased in line with October’s CPI inflation rate of 4.6% instead of September’s 6.7%, lone mother households will lose £218 a year.

- If benefits are frozen and not increased in line with September’s CPI inflation in 2024, lone mother households will lose £788 per year.

Dr Mary-Ann Stephenson, Director said:

“To preserve the real value of benefits, the Government should at the very least increase benefits by 6.7%, in line with September 2023 inflation. Families are living with the inflationary impacts on costs since this cost of living crisis started and are now going into what is likely to be an even tougher winter than last year. The debt support charity StepChange reported that women now make up 65% of their new clients, and they saw a 38% increase in users between 2022 and 2023.”

“If the Chancellor were to opt for today’s inflation figures, compared to September figures as has been rumoured, lone mothers will be £218 a year worse off. We therefore urge the Chancellor to protect women and children from falling further into poverty by using September’s rate as planned and providing some respite for struggling families living with the combined impacts of austerity, a global pandemic and the cost of living crisis.”

“Households on benefits are already far worse off as a result of the cuts and changes to benefits that have been introduced over the past 13 years, from Universal Credit, to the benefit cap and the two-child limit, the ‘bedroom tax’ and the benefits freeze. This has led to a growing use of food banks, rising homelessness and extreme measures taken by families to save money switching off basic necessities like fridges and freezers.

“Increasing benefits in line with September’s inflation rate will at least prevent the poorest families getting poorer, although it does not compensate for the impact of freezes and cuts to benefits of the last 13 years.”

Figure 1: change in disposable income per year, per household type for 2024 – AHC

Not increasing benefits will have a major negative effect on households with children, and particularly lone mothers.

Source: WBG estimations using UKMOD B1.08 and 2019 data

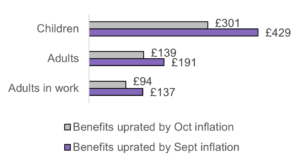

Figure 2: change in disposable income per year, per population group for 2024 – AHC

Children would be the most affected if benefits are not uprated.

Source: WBG estimations using UKMOD B1.08 and 2019 data

For more information or further comment, contact

erin.mansell@wbg.org.uk / press@wbg.org.uk

About the Women’s Budget Group

The UK Women’s Budget Group (WBG) is the UK’s leading feminist economics think tank, providing evidence and analysis on women’s economic position and proposing policy alternatives for a gender-equal economy. We act as a link between academia, the women’s voluntary sector and progressive economic think tanks.