Press Releases

Tax giveaways will benefit men more than women, say WBG

Date Posted: Wednesday 22nd November 2023

Responding to the Autumn Statement, Dr Mary-Ann Stephenson, Director of the Women’s Budget Group said,

“Rather than take the action needed to tackle the challenges in our crumbling public services, the Chancellor chose a pre-election tax giveaway that will benefit men more than women.”

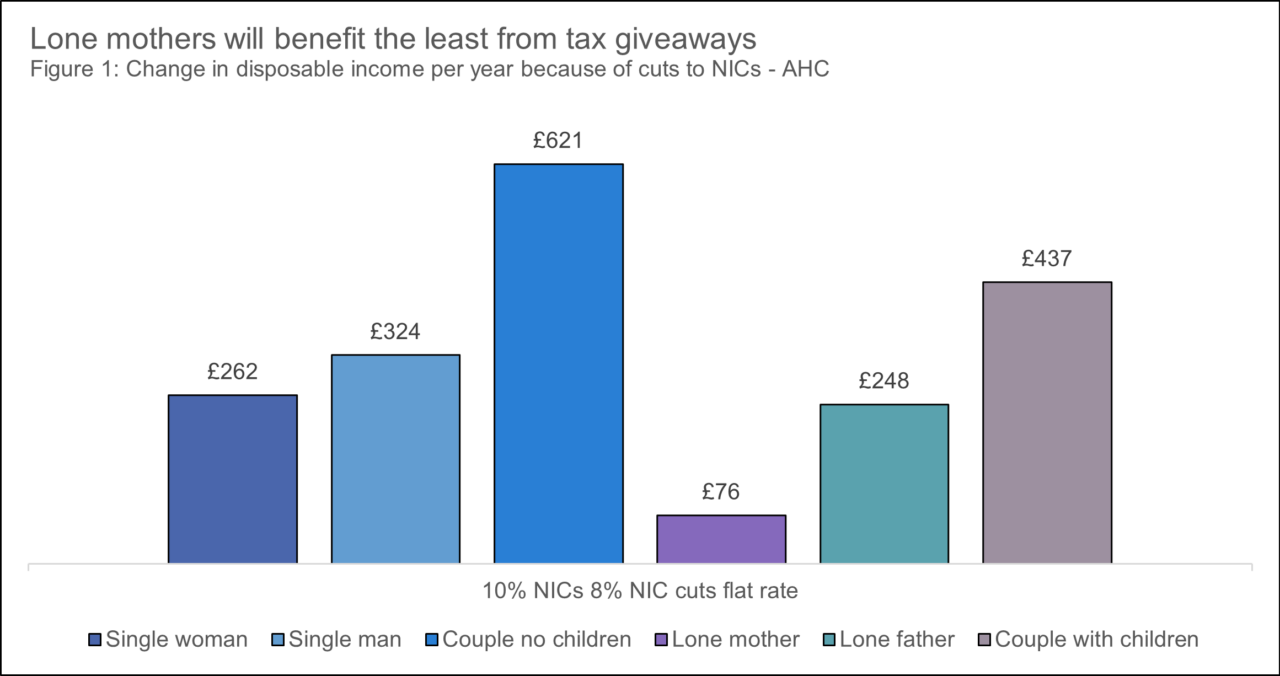

“On average, lone mothers stand to gain just £76 a year from the changes to NICs compared to £248 a year for lone fathers and £437 a year for a dual parent household. The number of lone parent households in destitution has tripled since 2019[1], they are the most likely to be hit by the benefit cap[2] and in greater need of local services like childcare and l health services.”

“We are heading into a winter that will be even tougher than last year for many of us. Cost of living payments are ending, but prices – in particular food, energy and housing costs – remain very high. Women are the shock absorbers of poverty and continue to bear the brunt of the cost of living crisis. Almost two-thirds of the debt charity StepChange’s clients seeking debt advice in 2023 were women.”[3]

“At the same time our public services are in urgent need of investment. There are 6.5 million people still waiting for treatment on NHS waiting list[4], our school buildings are literally crumbling and there were huge funding gaps of £2.4bn in 2023-4 with £1.6bn projected in 2024/25 for essential local authority services (including social care).[5] Our research has shown that women rely on, and benefit from public services much more than men.[6] But the chancellor has chosen to spend over £9bn on tax cuts[7] which will benefit men more than women.”

“This undermines the Chancellor’s own ambitions for economic growth. A healthy economy requires a healthy population. We currently have over 2.6 million people in this country who are economically inactive due to long term illness[8]; adult and child hunger at unprecedented levels[9] and millions of people with serious ill-health stuck on NHS waiting lists. Rather than supporting people to return to better health, the Chancellor has opted for increased conditionality and sanctions in the benefit system. Sanctions are not only punitive but have been proven to be ineffective at supporting people into work.”[10]

“We are facing a crisis in public services and a looming climate and ecological breakdown. Today, we needed to see policies with ambition to meet the scale of this challenge and instead the Chancellor chose pre-election tax giveaways.”

References

[1] https://www.jrf.org.uk/report/destitution-uk-2023

[2] https://wbg.org.uk/analysis/autumn-statement-2023-social-security-and-gender/

[3] https://www.stepchange.org/policy-and-research/women-and-debt.aspx

[5] https://www.localgovernmentlawyer.co.uk/governance/396-governance-news/55395-funding-gap-for-councils-in-england-continuing-to-grow-amid-inflationary-storm-lga-research

[6] https://wbg.org.uk/media/wbg-warns-against-austerity-2-0-a-triple-whammy-for-women/

[7] https://www.resolutionfoundation.org/comment/the-coming-tax-reshuffle-winners-and-losers/

[8] ONS, Economic inactivity by reason

[9] Time use in the UK: 23 September to 1 October 2023

[10] https://neweconomics.org/2023/08/majority-of-those-required-to-attend-jobcentres-say-fear-of-benefit-sanctions-undermines-their-prospects-of-finding-good-work

WBG spokespeople available for comment, contact

erin.mansell@wbg.org.uk / press@wbg.org.uk

About the Women’s Budget Group

The UK Women’s Budget Group (WBG) is the UK’s leading feminist economics think tank, providing evidence and analysis on women’s economic position and proposing policy alternatives for a gender-equal economy. We act as a link between academia, the women’s voluntary sector and progressive economic think tanks.